franklin county ohio sales tax rate 2020

The base state sales tax rate in Ohio is 575. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County.

Washington Sales Tax Guide For Businesses

Adamsville OH Sales Tax Rate.

. The 2018 United States Supreme Court decision in South Dakota v. The median property ta. Clinton County Hwy-NY 26962.

Be the first to know when a house in your area goes into foreclosure. This rate includes any state county city and local sales taxes. The sales tax rate for Franklin County was updated for the 2020 tax year this is the.

To make a payment you will need the following. 2020 rates included for use while preparing your income tax deduction. Franklins Income Tax Rate is 2 effective July 1 2011.

Auto Title Clerk of Courts. Ohio has a 575 sales tax and Franklin County collects an additional. Ada OH Sales Tax Rate.

Find your Ohio combined state and local tax. The latest sales tax rate for Franklin OH. The minimum combined 2022 sales tax rate for Franklin Ohio is 7.

The Franklin County sales tax rate is. Adams County OH Sales Tax Rate. The County assumes no responsibility for errors.

This is the total of state and county sales tax rates. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code May 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

Sales tax in Franklin County Ohio is currently 75. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. 2022 1st Quarter Rate Change.

The Ohio sales tax rate is currently 575. Child Support Child Support Enforcement. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Should you have questions please contact the Delinquent Tax. 2020 rates included for use while preparing your income tax deduction. State and Permissive Sales Tax Rates by County April 2022.

City Total Sales Tax Rate. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. The Ohio state sales tax rate is currently.

How much is sales tax in Franklin County in Ohio. If you are a property owner whose name is listed please click here for more information about your options. John Smith Street Address Ex.

Aberdeen OH Sales Tax Rate. Search for a Property Search by. The Franklin County Sales Tax is collected by the merchant on all qualifying sales made within.

The sales and use tax rate for. The December 2020 total local sales tax rate was also 7500. There is no applicable city tax or special tax.

Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates.

Building Permits Economic Development Planning. If you have any questions regarding your property taxreal estate tax. 123 Main Parcel ID Ex.

1 Benjamin Franklin Way Franklin Ohio 45005. Name Change Probate Court. Franklin County Sales Tax Rates for 2022.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Franklin County OH. You can print a 7 sales tax table here.

Ohio Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Washington Sales Tax Rates By City County 2022

Florida Sales Tax Rates By City County 2022

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

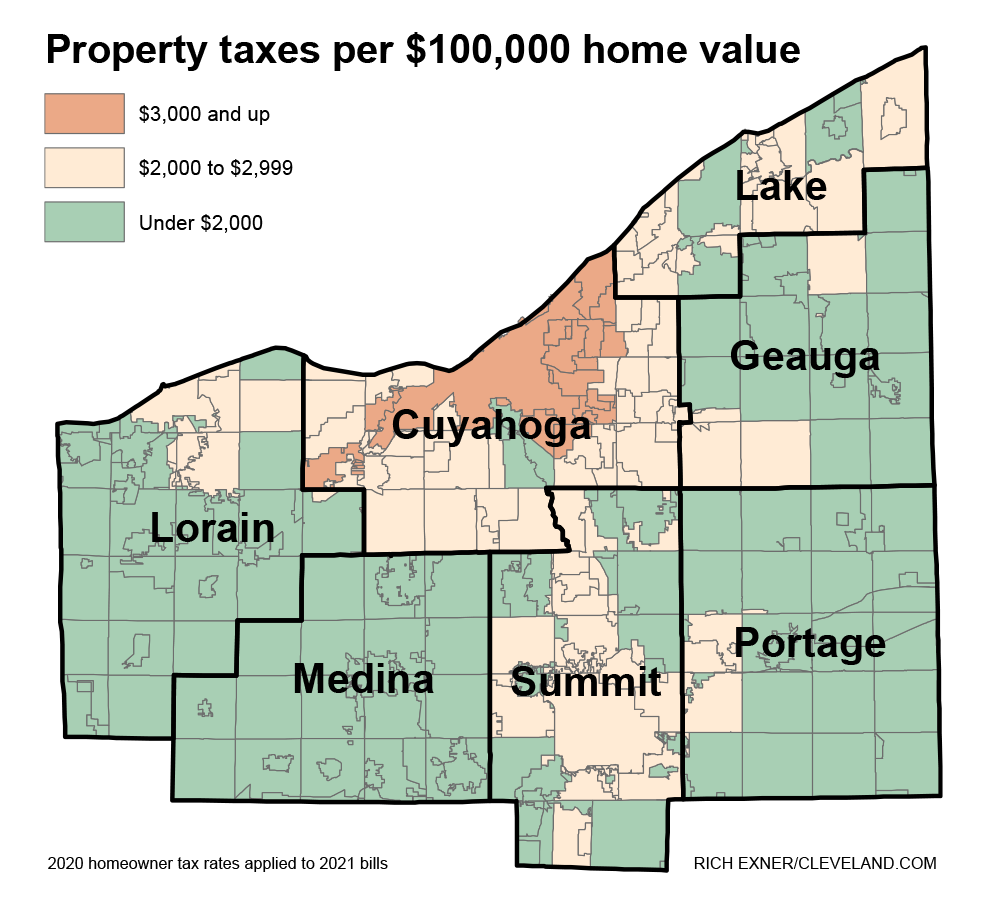

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Solving Sales Tax Applications Prealgebra

Ohio Tax Rates Things To Know Credit Karma

File Sales Tax By County Webp Wikimedia Commons

States With Highest And Lowest Sales Tax Rates

Kansas Sales Tax Rates By City County 2022

Solving Sales Tax Applications Prealgebra

Washington Property Tax Calculator Smartasset

State Local Property Tax Collections Per Capita Tax Foundation